What is a Non-Banking Financial Company (NBFC)?

- A NBFC is a financial institution that provides banking services without meeting the legal definition of a bank, i.e. one that does not hold a banking license.

- It is established as a company registered under the Companies Act, 1956 but its operations are often still covered under a country’s banking regulations.

- NBFCs may be engaged in the business of loans and credit facilities, savings products, investments and money transfer services.

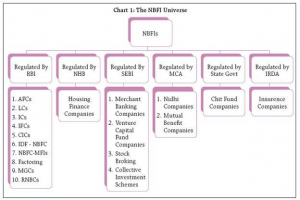

- The Reserve Bank of India is entrusted with the responsibility of regulating and supervising the Non-Banking Financial Companies by virtue of powers vested under Reserve Bank of India Act, 1934

What is difference between banks and NBFCs?

- NBFCs business activities are akin to that of banks as they can lend and make investments; however there are a few differences between them.

- NBFCs cannot accept demand deposits.

- They cannot issue cheques as they do not form part of the payment and settlement system.

- Deposit insurance facility of Deposit Insurance and Credit Guarantee Corporation is not available to depositors of NBFCs, unlike in case of banks.