Money Laundering:

-

Money laundering is the process by which large amounts of illegally received money is given the appearance of having originated from a legitimate source.

-

In India, the money laundering is regulated by the Prevention of Money Laundering Act 2002(PMLA) which came into force in 2005.

-

The act defines money laundering offence and provides for the freezing, seizure and confiscation of the proceeds of crime.

-

The provisions of this act are applicable to all financial institutions like banks, mutual funds, insurance companies, and their financial intermediaries.

-

The act was amended thrice, first in 2005, then in 2009 and 2012. PMLA(Amendment) Act, 2012 has enlarged the definition of money laundering by including activities such as concealment, acquisition, possession and use of proceeds of crime as criminal activities.

Why Money Laundering happens?

-

Criminal activities like illegal arms sales, smuggling, drug trafficking and prostitution rings, insider trading, bribery and computer fraud schemes produce large profits.

-

Thereby it creates the incentive for money launderers to “legitimise” the ill-gotten gains through money laundering.

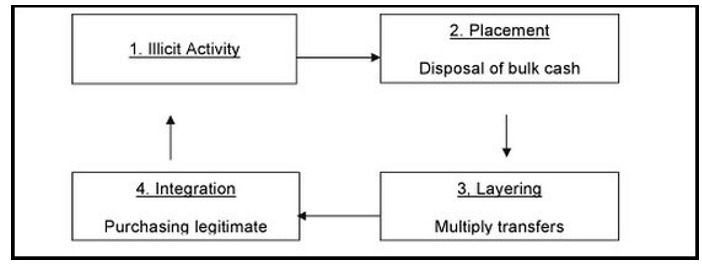

Process of Money Laundering:

Money laundering is a three-stage process :

-

Placement: The first stage is when the crime money is injected into the formal financial system.

-

Layering: In the second stage, money injected into the system is layered and spread over various transactions with a view to obfuscate the tainted origin of the money.

-

Integration: In the third and the final stage, money enters the financial system in such a way that original association with the crime is sought to be wiped out and the money can then be used by the offender as clean money.