What is GDP deflator?

-

The GDP deflator, also called implicit price deflator, is a measure of inflation.

-

It is the ratio of the value of goods and services an economy produces in a particular year at current prices to that of prices that prevailed during the base year.

-

This ratio helps show the extent to which the increase in gross domestic product has happened on account of higher prices rather than increase in output.

-

GDP price deflator measures the difference between real GDP and nominal GDP. Nominal GDP differs from real GDP as the later doesn’t include inflation, while the former does.

-

As a result, nominal GDP will most often be higher than real GDP in an expanding economy.

-

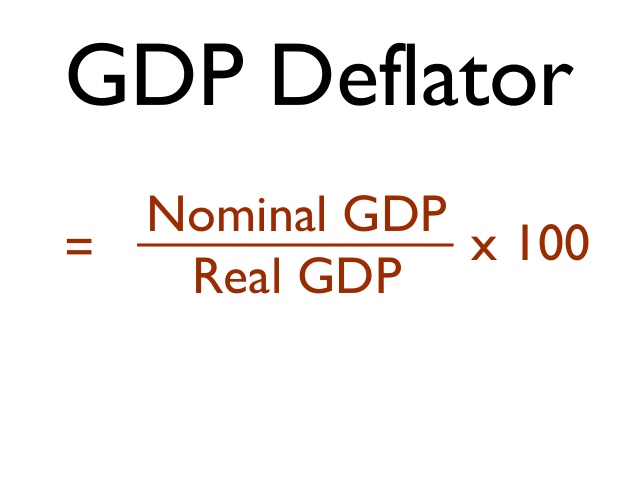

The formula to find the GDP price deflator:

-

GDP price deflator = (nominal GDP ÷ real GDP) x 100

Why GDP deflator is a better measure of inflation than CPI / WPI?

-

Since the deflator covers the entire range of goods and services produced in the economy — as against the limited commodity baskets for the wholesale or consumer price indices — it is seen as a more comprehensive measure of inflation.

-

A consumer price index (CPI) measures changes over time in the general level of prices of goods and services that households acquire for the purpose of consumption.

-

However, since CPI is based only a basket of select goods and is calculated on prices included in it, it does not capture inflation across the economy as a whole.

-

The wholesale price index basket has no representation of the services sector and all the constituents are only goods whose prices are captured at the wholesale/producer level.

-

Changes in consumption patterns or introduction of goods and services are automatically reflected in the GDP deflator.

-

This allows the GDP deflator to absorb changes to an economy’s consumption or investment patterns. Often, the trends of the GDP deflator will be similar to that of the CPI.

-

Specifically, for the GDP deflator, the ‘basket’ in each year is the set of all goods that were produced domestically, weighted by the market value of the total consumption of each good.

-

Therefore, new expenditure patterns are allowed to show up in the deflator as people respond to changing prices. The theory behind this approach is that the GDP deflator reflects up-to-date expenditure patterns.

-

Drawback: GDP deflator is available only on a quarterly basis along with GDP estimates, whereas CPI and WPI data are released every month.