Context

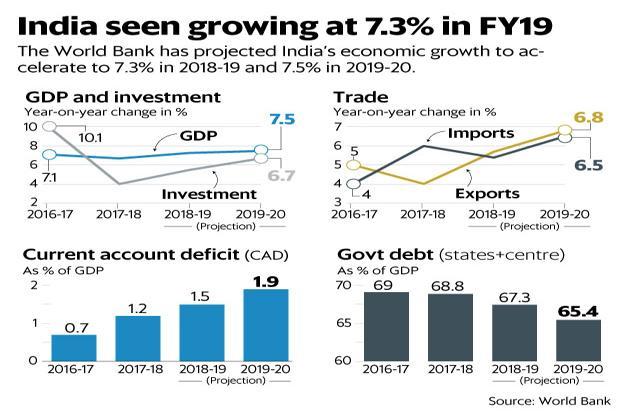

- After several quarters of low growth, there has been a strong pick-up in the last quarter of 2017-18. If this momentum is maintained, the growth rate (2018-19) will certainly be above 7%.

- Major concerns are- External environment, reviving the banking system, Impact on the fiscal position.

- Agricultural growth may at best be equal to what it was last year. As the monsoon has been somewhat below expectations — the overall rainfall was deficiency.

- The services sector may perform better because public expenditure will be maintained at a high level.

- As of the industrial sector, the data for the Index of Industrial Production (IIP) shows substantial improvement.

- The correlation between the IIP and national income data on manufacturing is poor.

- The problems of the goods and services tax (GST) may have been largely overcome.

Issues

External environment

- Trade wars have already started and can get worse.

- The U.S. has raised duties on several products such as steel and aluminum.

- China has retaliated as duties for some of its products has been raised.

- India has also been caught in this exchange.

- Iran, which have a direct impact on crude oil output and prices. India benefited from the fall in crude prices earlier but this position has reversed.

- India’s trade deficit has always remained high.

- The fall in crude oil prices had also affected the export growth.

- With the rising of trade deficit and some outflow of capital, the rupee has depreciated

- Solution:

- Improved efficiency in production and better infrastructure.

- Make the exports competitive.

- Maintenance of domestic stability.

- Search for an alternative fuel.

Reviving the banking system

- A/c to the RBI’s latest report on financial stability, shows that the gross non-performing asset (NPA) ratio of scheduled commercial banks rose.

- The high NPA level has a dampening effect on the provision of new credit. In fact, credit to the industrial sector has slowed down considerably.

- Solutions:

- Recapitalization of banks.

- Asset reconstruction companies, have been made to resolve the NPA issue.

- Medium-term banking reforms.

Impact on the fiscal position

- Central government’s fiscal has been within limits.

- There are two aspects of the fiscal which need to be kept under watch. – One relates to GST. It is estimated that GST revenues are currently running behind budgetary projections.

- The second concern relates to the impact of the proposed minimum support prices (MSPs) for various agricultural commodities. The MSPs have been raised sharply in the case of some commodities.

- Solution to MSP (If market prices fall below MSPs)-

- M.P. model- where the State pays the difference between market price and MSP. But this can turn out to be a serious burden if market prices fall steeply. This is apart from the administrative problems involved in implementing the scheme.

- The other alternative is for the government to procure excess production over normal production so that market prices rise. This alternative may be less burdensome. However, this alternative will not work if the MSP is fixed at a level to which the market price will never rise. .

Conclusion

- The expected growth rate of 7.3-7.4% may be reassuring. It may even be the highest in the world economy.

- It is below of what is needed to raise job opportunities and reduce poverty.

- It is true that the external environment is not helpful.

- Hence a stronger push towards a much higher growth is very much the need of the hour.