Utility: Direct question can be asked on this issue. Also, it can be quoted in answers related to India-US relations, Global Trade related questions.

What is the Digital Services Tax (DST) imposed by India?

The DST imposes a 2% tax on revenue generated from a broad range of digital services offered in India like:

-

Digital platform services

-

Digital content sales

-

Digital sales of a company’s own goods

-

Data-related services

-

Software-as-a-service, and several other categories of digital services

India’s DST only applies to “non-resident” companies.

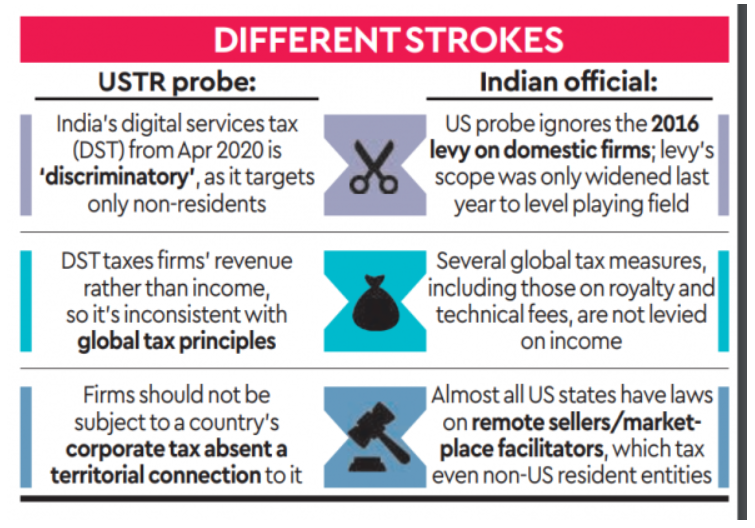

Objection of USTR:

-

The USTR’s Section 301 has claimed India’s DST is not in sync with international tax principles.

-

USTR has concluded the digital taxes imposed by France, India, Italy and Turkey discriminate against big U.S. tech firms, such as Google, Facebook, Apple and Amazon.com, referred to as the GAFA tax.

-

The issues of contention are the application of taxation to revenue rather than income, extraterritorial application, and failure to provide tax certainty.

India’s stand:

-

India has defended the 2% equalisation levy saying that it does not discriminate against U.S. companies as it applies uniformly across all non-resident e-commerce operators.

-

Intention of imposing such a levy is to create an ecosystem that fosters fair competition and reasonableness.

-

Another reason behind the levy is to exercise the sovereign right of the government to tax businesses that have a close nexus with the Indian market through their digital operations.

-

The charge of extraterritorial application is not accurate as it applies only to the revenue generated from India.

How did US react?

-

The US announced 25% tariffs on over $2 billion worth of imports from the six countries including India.

-

However, it immediately suspended the duties to allow time for international tax negotiations and due to the poor economic condition of countries during the pandemic era.

Way Ahead:

-

The countries should engage and negotiate peacefully on the concerning provisions. Imposition of unnecessary barriers by either side would only generate adverse results.

-

For instance, U.S tariffs would impact $118 million worth of Indian exports to the country.

-

Co-operation is desired as the world can hardly afford another tariff war in the post-COVID era.