-

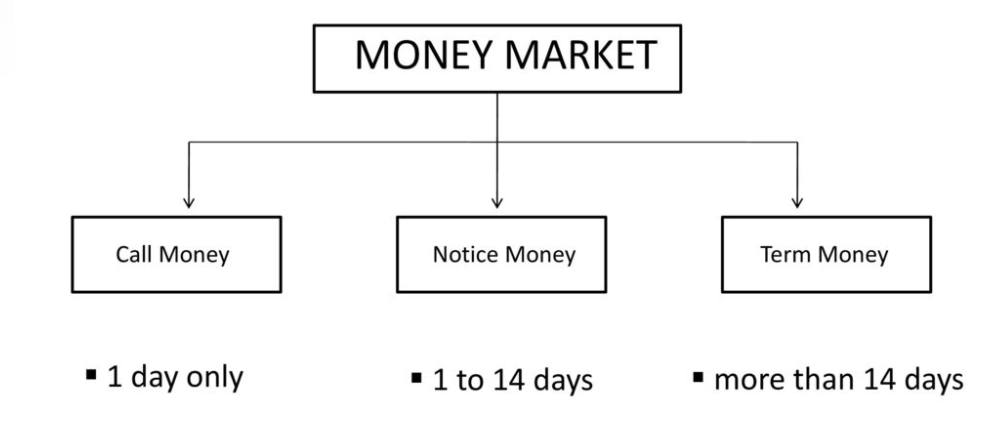

The call/notice money market forms an important segment of the Indian Money Market.

-

Under call money market, funds are transacted on an overnight basis and under notice money market funds are transacted for a period between 2 days and 14 days.

-

Why in News? Reserve Bank of India(RBI) has allowed regional rural banks (RRBs) to access the liquidity adjustment facility(LAF), marginal standing facility(MSF) and call or notice money markets with the aim to facilitate better liquidity management for these lenders.