Key shortcomings of the Budget:

-

Impact on revenue expenditure:

-

Revenue estimates have remained stagnant. Fiscal Consolidation targets require reducing expenditure to GDP ratio. Thus, to meet fiscal targets, revenue expenditure will be reduced.

-

-

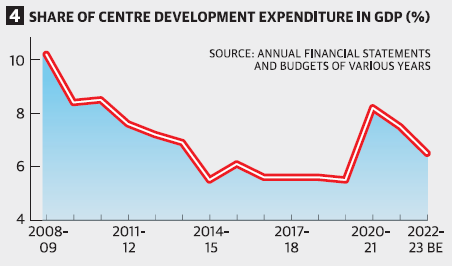

Implications for development spending:

-

Reduction in development expenditure will lead to fall in development expenditure.

-

-

Impact on income and livelihood:

-

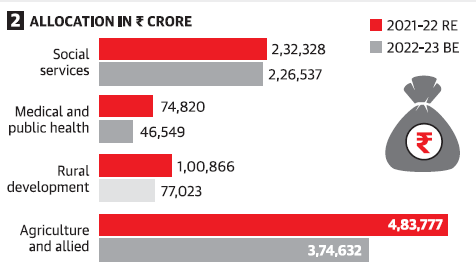

The reduction in the allocation for development expenditure ratio for 2022-23 reflects a reduction in the allocation for food subsidies, national rural employment guarantee program, expenditure in agriculture, rural development and social sector.

-

-

Impact on Income:

-

The reduced expenditure in the rural employment programme and employment-intensive sectors like the agricultural sector would have a marked impact on the income levels of the general populace.

-

-

Macro-economic perspective:

-

The reduction in the allocation for development expenditure would have an adverse impact on labour income and consumption expenditure. This could curtail the aggregate demand in the economy and depress the consumption expenditure which is so very critical for the Indian economy especially for the recovery process.

-

-

Heavy reliance on the external sector:

-

The budget approach signifies a heavy dependency on external demand for economic revival.

-

Despite the limited recovery in exports in the last few quarters, the possibility of sustained economic recovery relying exclusively on the export channel appears to be bleak at the present as different countries have already started pursuing fiscal consolidation.

-

-

Neglect of corporate tax as a revenue source:

-

Despite a sharp increase in profits during the pandemic, the corporate tax-GDP ratio has continued to remain below the 2018-19 level due to tax concessions. This restricts revenue receipts.

-

Despite the objective of fiscal consolidation, the corporate tax ratio continues to remain lo

-