Context:

-

According to RBI, India’s banks had 12.5% of their total loans categorised as non-performing or restructured at the end of March 2018.

-

But RBI in February 2018 had withdrawn half dozen loan restructuring schemes and tightened rules to steer more companies to bankruptcy courts.

-

It had issued revised framework for resolution of stressed assets.

-

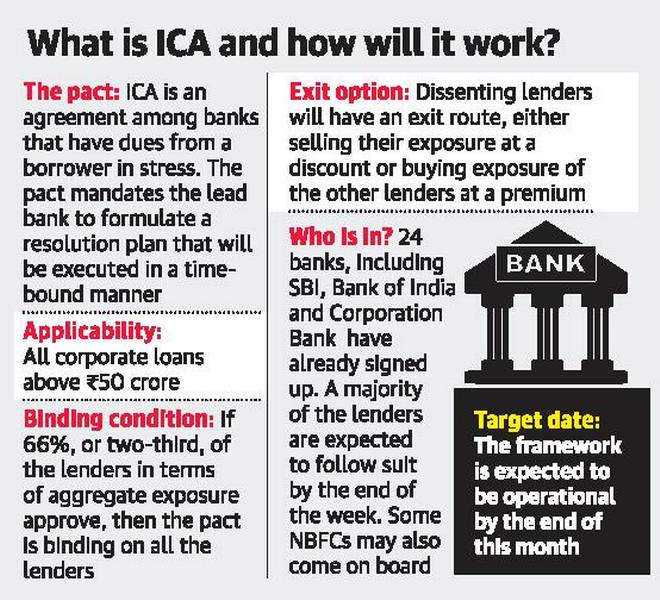

Besides, after recommendations of Government formed Sunil Mehta Committee, Inter-creditor Agreement was prepared under aegis of Indian Banks’ Association (IBA) to serve as platform for banks and FIs to come together and take joint and concerted actions towards resolution of stressed accounts.

Inter-Creditor Agreement (ICA)

-

ICA Framework is part of project ‘Sashakt’.

-

Under it, lead lender (having highest exposure) will be authorised to formulate resolution plan for operation turnaround of assets which will be presented to lenders for their approval.

-

It will be applicable to all corporate borrowers who have availed loans and financial assistance for amount of Rs. 50 crore or more under consortium lending or multiple banking arrangements.

-

Each resolution plan will be submitted by lead lender to Overseeing Committee.

-

The decision making under ICA framework will be by way of approval of majority lenders i.e. lenders with 66% share in aggregate exposure.

-

Once resolution plan is approved by majority lenders, it will be binding on all lenders that are party to ICA.

-

The plan formulated under ICA will be in compliance with RBI norms and all other applicable laws and guidelines.

-

Banks opposing resolution plan will have option to sell their stressed loans to company at discount or buy out loans to that entity from all other lenders at premium.

Significance of ICA framework

-

The ICA framework aims for faster facilitation of the stressed assets resolution.

-

It gives a bigger say to lead lender in consortium and allows resolution plan to be approved if 66% of the banks in the group agree to it.

-

It authorises lead bank to implement resolution plan in 180 days and leader would then prepare resolution plan.

-

If any lender dissents, the lead lender will have the right but not the obligation to arrange for buy-out of the facilities of the dissenting lenders at a value that is equal to 85 per cent of the lower of liquidation value or resolution value.

-

The dissenting lenders can exercise such right of buy-out in respect of the entire facilities held by other relevant lenders.

Why is this agreement important?

-

The disagreement between joint lenders was the biggest problem in resolving stressed assets. To overcome this issue inter-creditor agreement was introduced.

-

So, the government now hopes that the holdout problem, where the objections of a few lenders prevent a settlement between the majority lenders, will be solved through the inter-creditor agreement